When is the Budget and what might be in it?

When is the Budget and what might be in it?

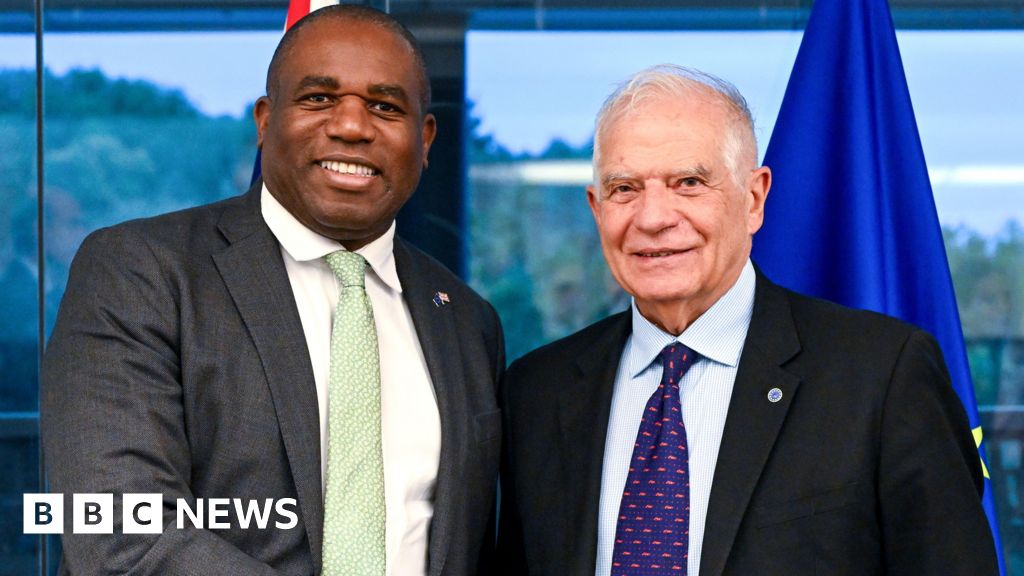

Getty Images

Chancellor Rachel Reeves will deliver Labour's first Budget on Wednesday 30 October. At the beginning of September, she told the BBC it would involve "difficult decisions" on tax, spending and benefits. However, her speech at the Labour Party conference was more optimistic about the future of the economy.

What is the Budget?

Each year, the chancellor of the exchequer - who is in charge of the government's finances - makes a Budget statement to MPs in the House of Commons. The speech outlines the government's plans for raising or lowering taxes. It also includes big decisions about spending on health, schools, police and other public services. The previous Conservative Chancellor, Jeremy Hunt, delivered the last Budget in March 2024, before the general election. But after a change of government, the new chancellor holds another Budget, in autumn, to set out their financial priorities.

When is the autumn Budget and what time is the speech?

The 2024 autumn Budget is on Wednesday 30 October. The Budget speech usually starts at about 12:30 UK time and lasts about an hour. It will be broadcast live on the BBC iPlayer and on the BBC News website. The current leader of the opposition, Conservative Party leader Rishi Sunak, will give a speech responding to the Budget as soon as Reeves sits down.

What happens after the Budget speech?

The Treasury, the government department in charge of the economy and public spending, publishes a report alongside the Budget speech. It gives more details about the measures announced and what they will cost. The independent Office for Budget Responsibility (OBR), which monitors government spending, also produces an independent assessment of the health of the UK economy. After the statement, MPs spend several days debating the plans. They are then asked to approve the proposals and the government introduces a Finance Bill to turn the Budget announcements into law.

How is the UK economy doing?

The chancellor's speech at the Labour Party conference confirmed that boosting the economy is one of the government's key priorities. Reeves talked about the "long-term prize" that would follow if Labour can restore stability. A growing economy usually means people spend more, extra jobs are created, more tax is paid and workers get better pay rises. Following a brief recession at the end of 2023, the UK grew solidly during the first six months of 2024, and recorded the fastest growth of all the G7 countries. However, the UK economy stalled in June and July. When Labour took power, Reeves said it had "inherited the worst set of circumstances since the Second World War" regarding government finances - something the Conservatives deny. She said she was facing a ?22bn "black hole", and warned that the government would have to raise some taxes as a result. This gap is due to rules the government has chosen to follow over how much money it can borrow over the next five years.

What might be in the Budget?

At the election Labour promised not to increase taxes on "working people", and said it would not raise VAT (value added tax), income tax or National Insurance. But after the warning about "difficult decisions", there has been a lot of speculation about other possible tax rises which could be announced: Capital gains tax (CGT) CGT is charged on the profit made from the sale of assets that have increased in value, such as second homes or investments. It is paid by individuals and some business owners, and the rates vary depending on how much income tax you pay. Inheritance tax (IHT) IHT, which is currently 40%, is usually paid on the value of a deceased person's assets above a threshold of ?325,000. Fuel duty Fuel duty has not risen in more than a decade. It was frozen between 2012 and 2022, and cut by 5p in March 2022 when pump prices surged following Russia's invasion of Ukraine. However, some motoring groups argue the cut was never passed on to motorists and the RAC says it could be reversed. Pension tax relief People who pay into private or workplace pension pots get tax relief on their contributions, up to a certain amount. This boosts the amount saved. At the moment, savers receive tax relief at the same rate as their income tax - so basic rate taxpayers get tax relief at 20% and higher rate taxpayers at 40% or 45%. The government could introduce a single flat rate of relief which would make the system less generous for higher earners. Reports have suggested this is unlikely, although other tax breaks in the pension system could be altered. Non-dom tax status The term "non-dom" describes a UK resident whose permanent home - or domicile - for tax purposes is outside the UK. As a result, they do not pay UK tax on money they make elsewhere. In the March Budget, the then-Chancellor Jeremy Hunt said non-dom tax status would be abolished, although there were some concessions. Labour has said it wants to toughen the existing plans, although these plans might be reconsidered amid worries they will bring in less money than expected. National Insurance contributions by employers The government's phrase that it would not raise taxes on "working people" has led to speculation that it could still increase National Insurance (NI) rates for employers. NI is paid by both workers and companies. Employers pay NI on their workers' earnings at a rate of 13.8%. At the moment companies do not pay NI on pension contributions they make to employees, but reports have suggested this could change in the Budget.