Did Your Credit Card's Annual Fee Go Up? Here are your Options

There was once a time when most cards had no annual fee or a modest fee of under $100. Now, many of the top credit cards have annual fees of several hundred dollars, and they keep going up.

As with any relationship that comes to a crossroads, you generally have two choices: stick around or break up. With your credit card, you may have other options.

Should you stick it out?

Your first choice is to keep the card and eat the fee increase. Thankfully, most card issuers regularly add new features and benefits to their cards, which might make a fee increase more palatable.

For example, when the American Express? Gold Card increased its annual fee from $250 to $325 (see rates and fees) earlier this year, it also added up to $100 in fee credits towards Resy dining and up to $84 in annual Dunkin credits. If you can take advantage of those credits, you might not mind the $75 increase.

When the fees increase on one of my cards, I like to weigh the value of the new features against the increased costs and make a decision as to whether or not the card deserves a continued place in my wallet. I realized I could use the Resy credits, so I decided to keep this card.

Is it time to move on?

If the new features aren't worth the additional cost, then you can always cancel your card. Yes, your credit score might take a temporary hit, but it's better than paying for a card you no longer want. This is where the other options come into play.

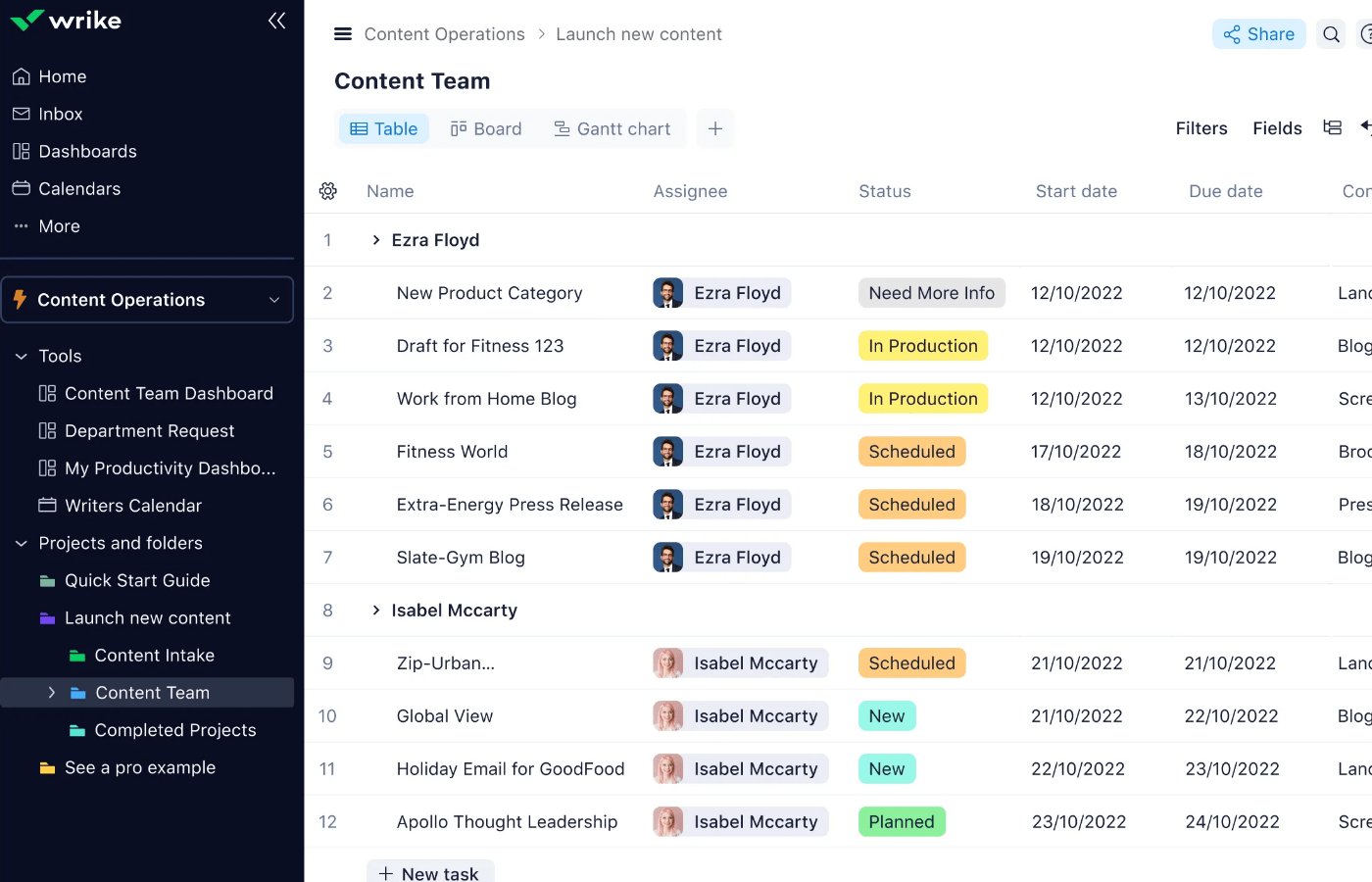

If you call the card issuer to close your account, you'll likely be transferred to an account specialist, which is actually a person in a special department called retentions.

As the name implies, this person's job is to retain you as a customer. To this end, the person you speak with may offer to give you some additional points or miles if you choose to renew your card, perhaps after meeting a spending goal.

You could be offered a new type of card while retaining your old card number, balance, and payment information. This kind of offer is typically referred to as a product change and can be a compelling way to avoid the annual fee increase. If I speak to someone in retentions and I don't like the offer, I can still just cancel the card, which I often do. Your other option would be to downgrade your card to a non-annual fee card.

You're still the captain of your ship

Credit card issuers are diving into the trend of increasing fees, but it doesn't mean that you have to tag along for the ride. If the card's new features and benefits don't justify its new cost to you, then it might be time to break up. You can always tell the card issuer, "It's not you, it's me."

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.